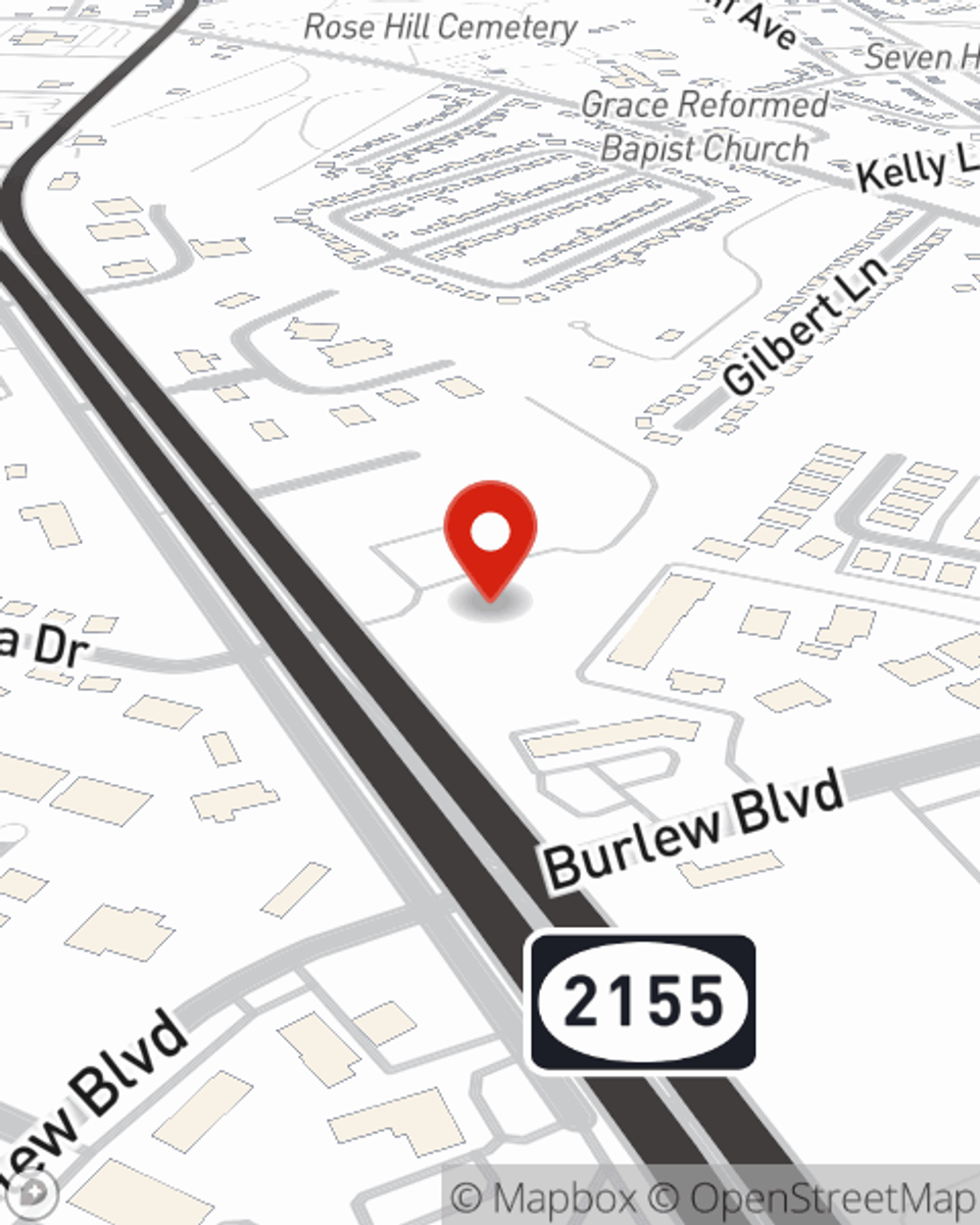

Business Insurance in and around Owensboro

Owensboro! Look no further for small business insurance.

Almost 100 years of helping small businesses

- Philpot

- Whitesville

- Utica

- Calhoun

- Livermore

- Daviess County

- Mclean County

- Henderson County

- Ohio County

- Hancock County

Coverage With State Farm Can Help Your Small Business.

Operating your small business takes dedication, effort, and terrific insurance. That's why State Farm offers coverage options like business continuity plans, errors and omissions liability, a surety or fidelity bond, and more!

Owensboro! Look no further for small business insurance.

Almost 100 years of helping small businesses

Cover Your Business Assets

When you've put so much personal interest in a small business like yours, whether it's a drug store, an appliance store, or a photography business, having the right insurance for you is important. As a business owner, as well, State Farm agent Branden Haines understands and is happy to offer customizable insurance options to fit your business.

Call or email agent Branden Haines to learn more about your small business coverage options today.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Branden Haines

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.